Campus Activewear is a leading footwear company in India. The company sells sports shoes, casual shoes, sandals and slippers.

Campus has also tried to diversify by selling T-shirts, trackpants and other apparel.

The company has 5 manufacturing facilities in India, and sell its products across 20,000 multi-brand stores – along with exclusive ‘Campus’ outlets.

They do not have separate sub-brands within the ‘Campus’ umbrella. Instead, they offer a diverse product portfolio within the ‘Campus’ brand itself, catering to different styles, needs, and price points.

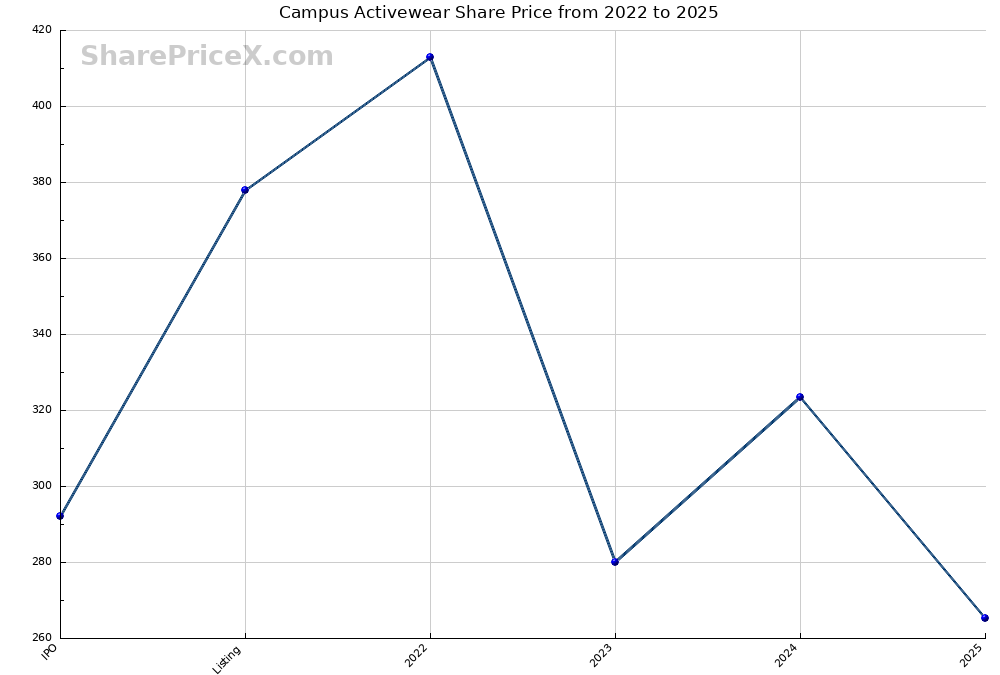

The Campus Activewear IPO was held in the year 2022. Post-listing, the stock witnessed a strong run-up with share price doubling from IPO levels.

The downtrend began at the end of 2022 and continued throughout 2023 – a year where retail companies struggled due to inflation and other economic factors.

At the end of 2023, the share price of Campus Activewear was trading below its IPO price.

Campus Activewear Share Price History

| Year | Share Price | Gain / Loss |

|---|---|---|

| IPO | ₹ 292.00 | |

| Listing | ₹ 378.00 | + 29.5% |

| 2022 | ₹ 413.00 | + 9.3% |

| 2023 | ₹ 279.90 | - 32.2% |

| 2024 | ₹ 323.30 | + 15.5% |

| 2025 | ₹ 265.15 | - 18.0% |

Campus Activewear Share Price Chart

Click here for high resolution Campus Activewear Share Price chart

Click here for high resolution Campus Activewear Share Price chart

Campus Activewear Share Calculator

Enter any amount in the 'Investment amount' field and select a year.

The Campus Activewear calculator will tell you the value of your Campus Activewear investment in 2025.

Invested Amount

Investment Year

- During 2022, the share price of Campus Activewear was ₹ 292.

- If you had bought shares worth ₹ 2500 in 2022, you would have 86 shares today.

- At the end of 2025, the current value of your shares would be ₹ 22701.

Campus Activewear Share Returns

Invested Amount

Investment Year

Other Investment

Interest Rate